6 Easy Facts About How Many Years Can You Finance An Rv Shown

You can save some cash and have a more budget friendly payment if you pick to buy an utilized lorry. There are nevertheless, some trade-offs to purchasing utilized, too. There are some 0% and other low-rate financing deals offered for secondhand cars and trucks at shorter terms, such as 36 months that could decrease your payment if you certify. Many people go buying a cars and truck and discover one they like before they think of funding. That's backwards. You're more likely to succumb to car dealership sales strategies and buy a more expensive car than you can afford when you shop by doing this. Rather, get preapproved for a loan with a bank, cooperative credit union or online lender.

With a preapproval, you'll know how much you can obtain to pay for the automobile and what the month-to-month payment would be. You'll have a loan quantity and rate of interest that you can utilize to compare with the financing choices from the dealership and other lenders. You'll be prepared to make an informed decision when you find the cars and truck you desire. Lenders look for a high credit report for an 84-month loan term, so examine to see what your credit might be prior to using. That way you'll know which lenders may give you preapproval. With just a little preparation, you can get preapproved by a bank, cooperative credit union or online loan provider.

Lenders will use your creditworthiness to identify the interest rate they will offer you. Remember that the credit report for a car loan is a bit various from other loans. Get your details together before you visit a lending institution or use online. You'll require paperwork like: Personal information, consisting of name, address, contact number and Social Security number. Employment Info, such as your employer's name and address, your task title and salary, and length of work. Financial info, including your current debts, your living situation, what kind of credit you have offered and your credit history. Loan details, consisting of the quantity you expect to fund and the length of the loan term you desire, in addition to any trade-in or deposit info.

Search for the finest auto loan rates. If you're buying an automobile, multiple credit inquiries made within 14 to 45 days will not https://www.businessmodulehub.com/blog/4-things-to-know-before-buying-your-first-real-estate-property/ hurt your credit report any more than a single query would. If you're successful in getting preapproved, you'll get a loan quote that reveals much you qualify for, the rate of interest and the length of the loan. You can use this details when you go patronizing the dealer. You'll understand just how much you can afford to invest in the vehicle. And you'll have the ability to compare financing offers. If you have less than good credit, a cosigner might assist you receive a loan that you may not have the ability to get on your own.

Remember the cosigner is accountable for paying the loan if you don't pay it. That might negatively impact their credit history in addition to yours. If the cosigner is a good friend or family member, ensure they know their commitment to the loan. Know a few financing traps dealerships may utilize while you're purchasing a car. If you can recognize what the dealership is doing, you can avoid paying more than you planned. Research study the producer's recommended market price (MSRP) of the car you're looking at, and any incentives that may be available. The sticker label rate can vary by trim levels and alternatives, so research the alternatives you desire.

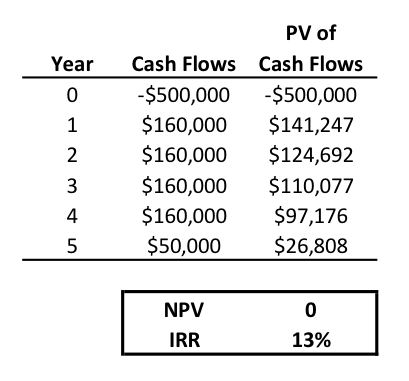

Things about What Is Internal Rate Of Return In Finance

Be cautious of dealer add-ons that are often provided at the last of settlement, such as: Nitrogen in the tires, Upholstery and paint defense plans, Lorry service contracts, Window tinting, Window vehicle recognition number (VIN) engraving plans, Research study your car's value on websites like Kelley Blue Book and Edmunds to see the market rate for a trade-in in your location. If you still owe money on the cars and truck, and particularly if you owe more than the vehicle deserves, you could have less working out power. Do not lose sight of how much the cars and truck will cost you through the life of the loan - Which of the following approaches is most suitable for auditing the finance and investment cycle?.

Look at the total expense of the purchase rate plus the overall quantity of interest before you settle on a loan term. This where the loan preapproval will assist keep you on track. Have a common sense of how much you can obtain and just how much you can afford to pay each month considering your other responsibilities. Leasing can be a great alternative to a longer loan term. You could drive the exact same vehicle for a lower monthly payment, although leases are generally 36 to 37 months. Prior to you rent, comprehend the advantages and disadvantages compared to buying a cars and truck.

Among the factors is the typical new lease payment is $466, while the average monthly payment for a brand-new loan is $569, Zabritski stated. Advantages and disadvantages of Leasing vs. Buying an Automobile, Payments on a lease are $100 less usually compared to purchasing, according to Experian. Payments are more for a loan, but when it's paid off, you own the car. Throughout the average lease of 36 months, your automobile will be under complete service warranty coverage. You can purchase extended guarantees or lorry service contracts. Otherwise, you are accountable for maintenance costs. You can relocate to a brand-new car at the end of the 36-month lease rather of being locked into a long-lasting cars and truck loan.

Leases normally permit 10,000-15,000 miles per wfg logo png year, and you'll pay more for extra miles, either in advance or at the end of the lease. Limitless miles when you own the vehicle. You'll pay extra for upholstery spots, paint scratches, dents, and use and tear above the normal when you turn the vehicle in. Wear and tear could lower the resale or trade-in worth. The worth of the vehicle is set at the end of the lease and disallowing high mileage or extreme wear-and-tear, it shouldn't alter - Which of the following can be described as involving direct finance. The automobile's worth may not be as much as you owe on it and can continue to depreciate as the cars and truck ages.

The average rate for new-car purchasers is 5. 61% while used automobile buyers pay a typical 9. 65%, according to Experian - How to finance a second home. You can generally finance a brand-new automobile for 24 months as much as 96 months or eight years. The average loan term is 70. 6 months. Utilized vehicles can generally be funded as much as 72 months, although it can depend upon the age and mileage of the automobile.

The 8-Second Trick For What Is Internal Rate Of Return In Finance

If you're buying a vehicle, you may need to fund your purchase with an auto loan. Auto loan differ in length depending upon the needs of the debtor. The average auto loan length might be the most suitable length for your loaning requires. Some people select longer loan terms because it enables them to make smaller regular monthly payments. Despite the fact that the payments are spread out over a longer period of time, each payment is more affordable. Let's state you are financing a $30,000 vehicle over five years at 3 percent APR without any deposit and no sales tax. Month-to-month payments would cost $539 each month.